Finance Minister Nirmala Sitharaman has announced the merger of country's top public sector banks. Finance Minister merged the 10 state-run PSB's into 4. Now the total tally of country 27 PSB banks has come down to 12. FM has said that the merger is aimed to create fewer but stronger global sized banks for building a $5-trillion economy.

Consolidation of Punjab National Bank, Oriental Bank of Commerce and United Bank:-

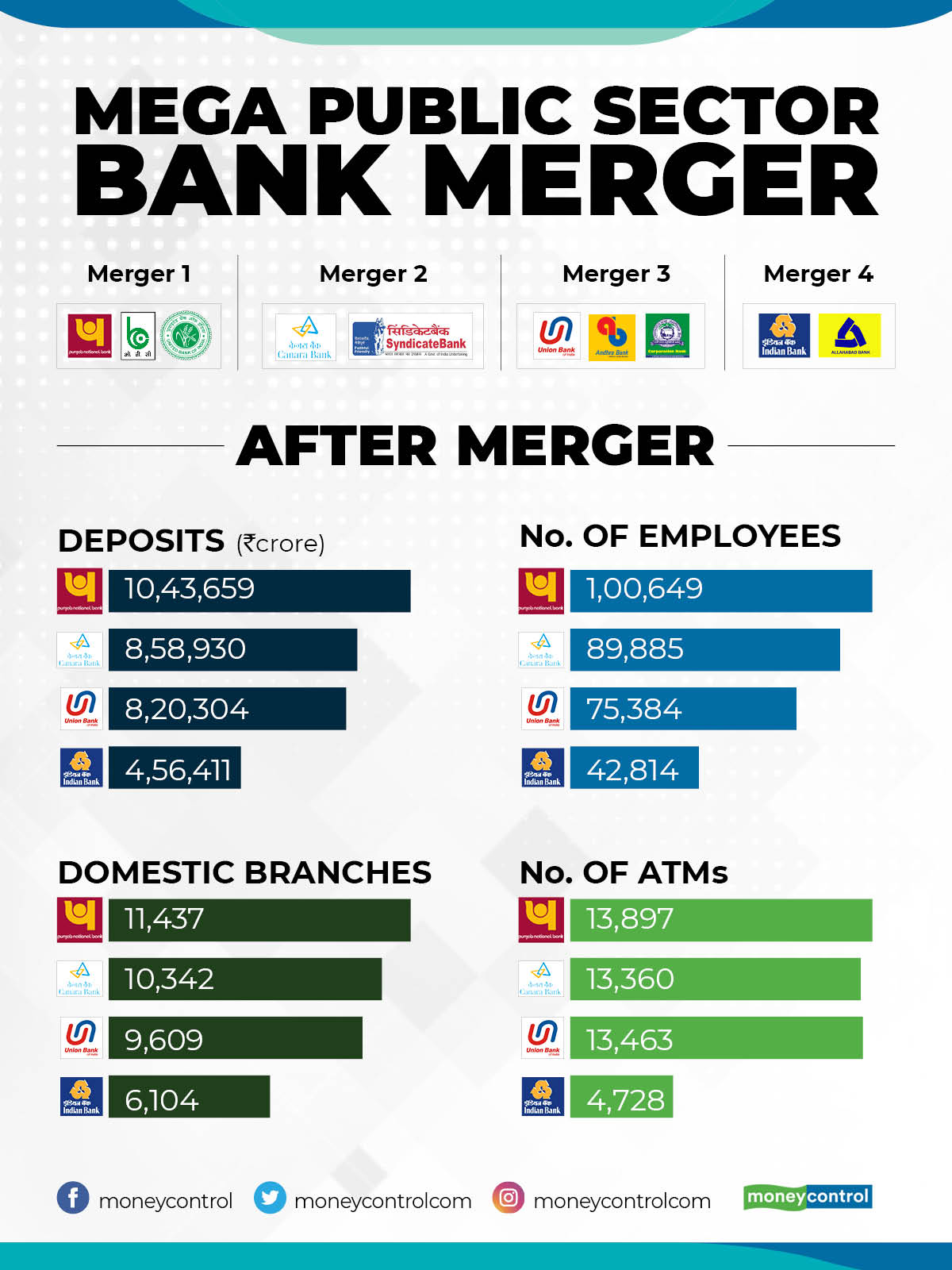

- The merged entity would be the 2nd largest PSB with Rs 18 lakh crore business and 2nd largest network with 11, 437 branches across India.

- The merger would lead to a high Current And Savings Account (CASA) ratio and high lending capacity.

- Same Core Banking System (CBS), Finacle, in all three banks would enable quick resolution of gains.

Consolidation of Canara& Syndicate Bank:-

- The merged entity will be the fourth largest PSB with Rs 15.2 lakh crore business and third-largest network with 10,342 branches

- Synergies, culture & common CBS platform to enable the quick realization of operational gains & enhanced lending capacity.

Consolidation of Union, Andhra & Corporation Banks:-

- The merged entity would be the fifth-largest PSB with Rs 14.6 lakh crore business and fourth-largest network with 9,609 branches in India.

- Strong scale benefits to all 3 with business becoming 2 to 4.5 times that of an individual bank.

Consolidation of Indian & Allahabad Bank:-

- The merged entity to be the 7th seventh-largest PSB with Rs 8.08 lakh crore business.

- Strong scale benefits to both with business doubling.

- High CASA & lending capacity combined in a consolidated bank.

Impact of bank merger:-

- Cheque books:-

The existing Cheque books will remain valid for some time, ultimately they will be replaced with the Cheque books of the merged entity. - IFSC codes:-

You would have given your bank account numbers and IFSC codes for various financial transactions -- auto credit of dividends via ECS, auto-credit of salary, auto-debit of various bills/charges, etc. Unless these accounts are seamlessly merged into the financial system of the newly merged bank, you would be required to change the details of your bank given for these purposes. - Credit/debit cards:-

Cards issued by the merging banks may have to be exchanged for those of the merged entity although the former is likely to remain valid for the interim period to ensure no disruption in services. - Deposit, lending rates:

No change. However, if you have a marginal cost of funds-based lending rate or MCLR-linked rate, it will change after the reset period. Also, if you book a new fixed deposit or take a fresh loan, the rate will be decided by the merged entity. Similarly, the savings account interest rate may change - Home branch:

There may now be a branch that’s closer/farther to you, depending on the merged entity's decision Account number: This will not change immediately. But if your bank has been merged with a bigger bank, there could be a change eventually and you could be allotted a new account number/customer-id. - EMIs/ECS mandate:

You may have to submit new forms online or through branches - Shareholders:-Shareholders of the publicly listed banks will be impacted. How much the respective shareholders will be impacted will be known once the swap ratios are announced.

Post a Comment